1

/

of

1

Taxumo Partner Services

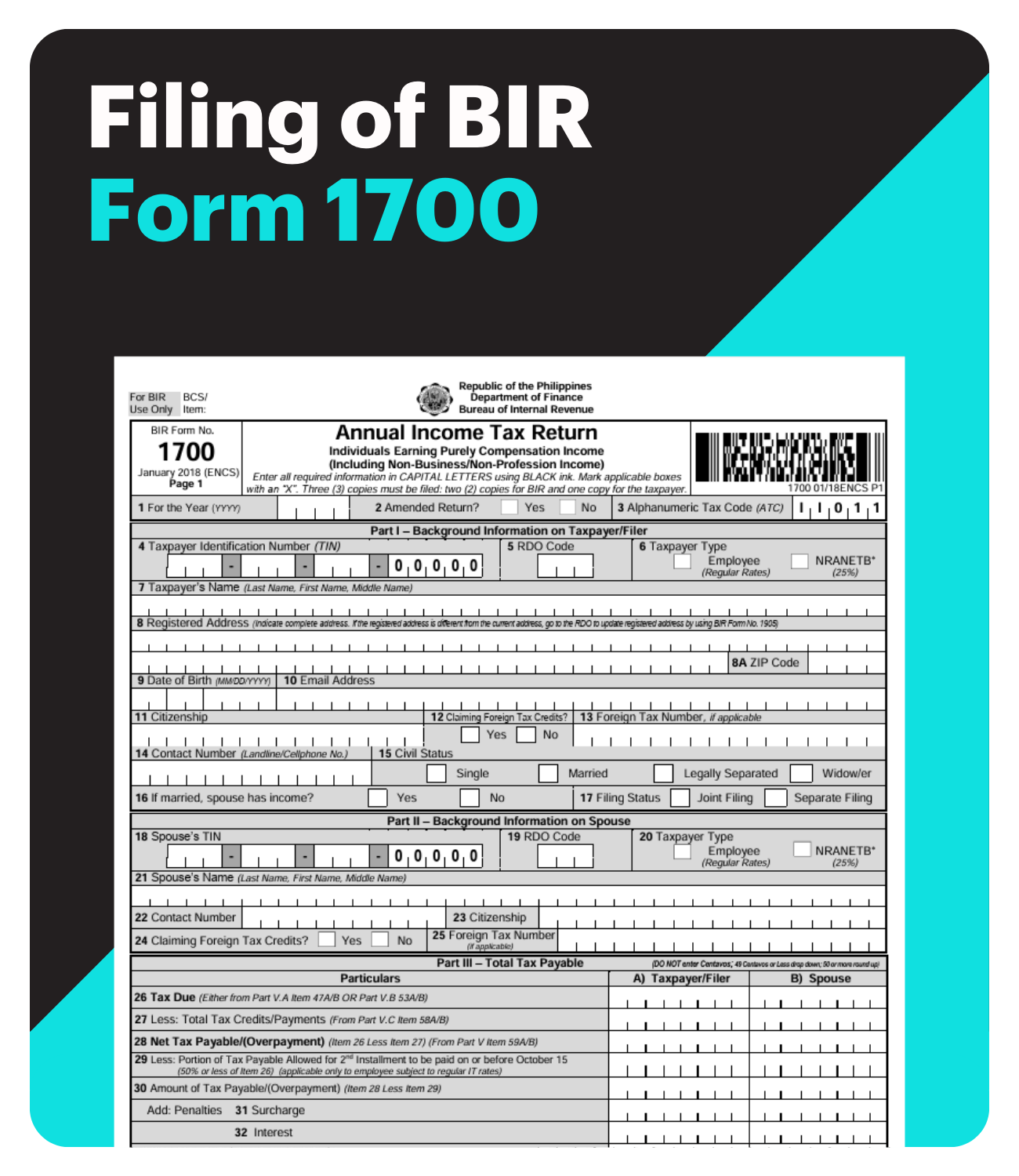

Filing of BIR Form 1700

Filing of BIR Form 1700

Regular price

₱3,500.00 PHP

Regular price

Sale price

₱3,500.00 PHP

Unit price

/

per

Couldn't load pickup availability

Description

BIR Form No. 1700 – Annual Income Tax Return for Individuals Earning Purely Compensation Income, including income not related to business or professional activities. This form is used to report income earned exclusively from employment and other non-business sources within the tax year.

Who Needs to File BIR Form 1700?

This form is required for individuals earning purely compensation income from one or more employers, including those with non-business or non-professional related income, who meet any of the following conditions:

- Had multiple employers during the taxable year.

- Changed jobs within the year.

- Did not qualify for substituted filing (where the employer files on their behalf).

Includes

- Complete preparation, calculation, and filing of BIR Form 1700 with the BIR to ensure compliance.

- Facilitating the payment from the customer to the BIR (if applicable).

Reminders

- Price includes VAT.

- All orders are final and non-refundable.

- The amount payable for the tax return will be invoiced separately.

Share